Poll: Americans Prefer Trump on Economic Issues

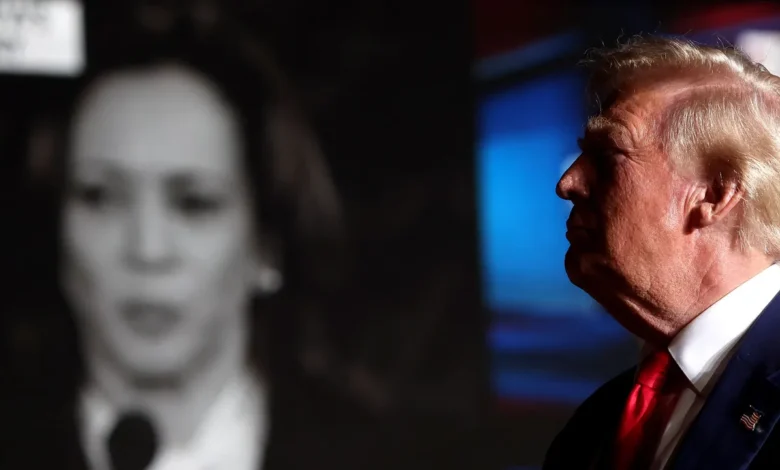

A recent Financial Times poll shows that Donald Trump surpasses Kamala Harris as the candidate Americans trust more to handle the economy, highlighting the Democratic Party’s struggle to convince voters they are better off than four years ago.

The latest monthly survey conducted by Financial Times and the Ross School of Business at the University of Michigan revealed that 44% of registered voters trust Trump more on economic matters, compared to 43% for Harris. This marks the first time Trump has led over Harris on this issue, less than two weeks before the election.

Professor Eric Gordon from the Ross School of Business commented that Harris’s economic proposals “have generated as much disappointment as enthusiasm,” adding, “If Harris is to win the election, she’ll need to succeed on other issues.”

Voters remain burdened by high living costs caused by inflation surges in 2022, which have kept prices elevated and continue to impact consumer sentiment. Over three-quarters of voters cited rising prices as one of their biggest financial pressures, a figure that has remained steady over the past year.

Trump has promised to reduce living costs by lowering energy prices and taxes, including those on tips, overtime for hourly workers, and senior benefits.

Harris, frequently referencing her experiences growing up in a “middle-income” family, has proposed an “opportunity economy” focused on supporting less affluent families. This includes a federal campaign against price manipulation, first-time homebuyer support, and aid for small businesses. Her platform promises tax cuts up to $6,000 per person and $50,000 for small businesses.

In the first debate, Harris criticized Trump’s plan, claiming it primarily benefits billionaires and large corporations, as in past policies. She highlighted the issues of housing and rising home prices, proposing measures to lower housing costs and create opportunities for all Americans.

Conversely, Trump remains committed to a protectionist agenda, advocating for higher tariffs—no less than 10% on imports globally and 60% on Chinese imports specifically. If fully implemented in a Trump administration, such measures could lead to significant disruptions in trade and investment flows, as other countries might impose retaliatory measures, sparking a cycle of competitive currency devaluations and increased tariffs. Trump also appears more assertive regarding fiscal stimulus.

Meanwhile, over half of U.S. Nobel laureates in economics signed a letter describing Harris’s economic agenda as “substantially superior” to Trump’s plans.